The Own Risk and Solvency Assessment (ORSA) is a critical process within the insurance industry that ensures companies maintain adequate capital and effectively manage risks. This blog will delve into various aspects of ORSA and related concepts to provide a comprehensive understanding of its significance.

One of the key components of an ORSA is the identification and assessment of risks that an insurance company faces. This entails not only evaluating current risks but also predicting potential future risks that could impact the company’s financial stability. By conducting a thorough risk analysis, companies can implement appropriate measures to mitigate identified risks and ensure continued solvency. This proactive approach fosters a culture of risk awareness within the organization.

In addition to risk assessment, ORSA requires companies to maintain adequate capital reserves to meet their obligations. Ensuring sufficient capital is crucial for the long-term sustainability of an insurance firm, as it provides a financial buffer during periods of economic uncertainty or unexpected claims. Regular review and adjustment of capital plans can enhance a company’s resilience, allowing it to navigate challenges effectively while securing stakeholder confidence in its operations.

Own Risk and Solvency Assessment (ORSA)

ORSA is a self-assessment tool used by insurance companies to evaluate their risk profiles and solvency positions. It ensures that insurers are adequately capitalized to withstand financial stresses and fulfill policyholder obligations. The ORSA process involves identifying, assessing, and managing risks that could impact the company’s ability to meet its financial obligations.

Furthermore, ORSA also emphasizes the importance of effective governance and oversight within an insurance company. Having a well-defined governance structure ensures that risk management practices align with the overall business strategy. Regular oversight by senior management and the board contributes to a more informed decision-making process, facilitating timely adjustments to risk appetite and capital strategies. This strategic alignment is vital for enhancing the company’s adaptability to market changes and regulatory expectations.

ORSA Framework

The ORSA Framework provides a structured approach for insurers to conduct their risk and solvency assessments. It includes policies, procedures, and governance structures that guide the ORSA process. A robust ORSA Framework ensures that risk management practices are integrated into the company’s overall strategy and decision-making processes.

A successful ORSA implementation requires ongoing communication and collaboration among various departments within the insurance company. By fostering a culture of shared responsibility, organisations can ensure that all relevant parties are engaged in the risk assessment process. This collaboration not only enhances the accuracy of risk evaluations but also promotes a more comprehensive understanding of the company’s overall risk landscape. Ultimately, a unified approach empowers insurers to respond more effectively to emerging risks and regulatory challenges.

Solvency II

Solvency II is a European Union directive that regulates insurance companies’ solvency and risk management standards. It requires insurers to maintain sufficient capital to cover their risk exposures and adhere to rigorous governance and reporting requirements. ORSA is a fundamental component of the Solvency II framework, promoting transparency and financial stability in the insurance sector.

The implementation of an effective ORSA process not only aids in regulatory compliance but also enhances an insurer’s strategic decision-making capabilities. By integrating risk assessments into their business planning, companies can adapt more readily to changes in the market and evolving regulatory landscapes. This forward-thinking approach helps to build resilience and sustainable growth, ensuring that insurers are well-positioned to address potential challenges. Ultimately, a comprehensive ORSA fosters greater trust among stakeholders, reinforcing the company’s commitment to sound risk management practices.

Risk Management in Insurance

Risk Management in Insurance involves identifying, assessing, and mitigating risks that can affect an insurance company’s financial health. Effective risk management ensures that insurers can meet their obligations to policyholders and maintain financial stability. ORSA plays a crucial role in enhancing risk management practices within insurance companies.

A critical aspect of enhancing risk management practices in insurance is adopting advanced analytical tools and technology. By leveraging data analytics and modelling, insurers can gain deeper insights into potential risks and market trends. This proactive stance allows companies to not only identify existing vulnerabilities but also to anticipate future challenges effectively. Ultimately, integrating technology into the ORSA process reinforces the insurer’s ability to make informed decisions and strengthen its overall risk management framework.

Insurance Regulatory Compliance

Insurance Regulatory Compliance refers to adhering to laws, regulations, and guidelines set by regulatory authorities. ORSA is a key requirement for regulatory compliance, ensuring that insurers maintain adequate capital and manage risks effectively. Compliance with ORSA requirements helps insurers avoid penalties and maintain their operating licenses.

In addition to leveraging technology, fostering a culture of risk management throughout the organization is essential for long-term success. By encouraging employees at all levels to engage in risk awareness and reporting, companies can create a more resilient environment. Training programs and workshops can enhance understanding and collaboration among teams, leading to more effective implementation of risk management strategies. This collective effort strengthens the overall governance framework and ensures that risk considerations are embedded in daily operations.

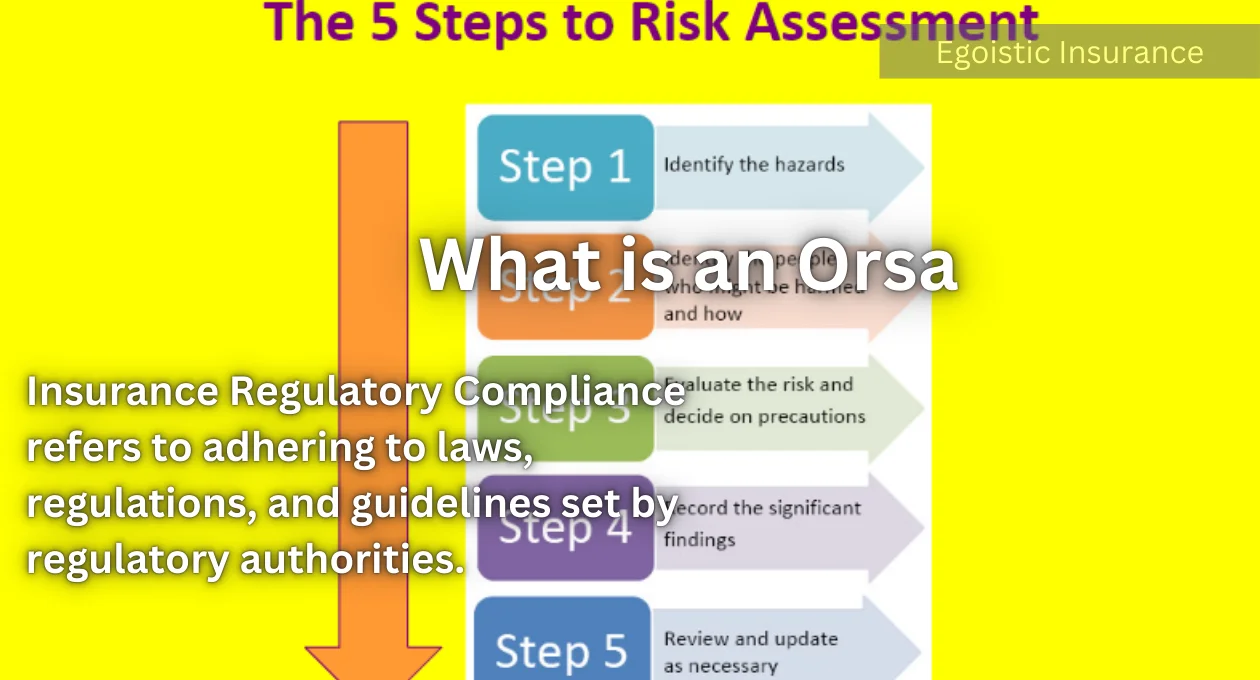

Risk Assessment Procedures

Risk Assessment Procedures involve systematic processes for identifying and evaluating risks. These procedures are integral to the ORSA process, enabling insurers to understand their risk exposures and implement appropriate mitigation strategies. Effective risk assessment procedures contribute to the overall stability and resilience of insurance companies.

Furthermore, it is essential for insurance companies to continuously review and improve their risk assessment procedures to remain resilient in an ever-changing marketplace. Regular updates to these procedures allow insurers to adapt to new risks and challenges, ensuring they are equipped to protect their policyholders effectively. Incorporating feedback from various stakeholders can enhance the accuracy and relevance of risk evaluations. Ultimately, a dynamic approach to risk assessment paves the way for sustained operational excellence and market competitiveness.

Capital Adequacy

Capital Adequacy refers to the sufficiency of an insurance company’s capital to cover its risk exposures. ORSA ensures that insurers maintain adequate capital levels to withstand financial stresses and continue operations. Adequate capital protects policyholders and promotes confidence in the insurance market.

Maintaining a strong capital position is essential for insurance companies, as it not only safeguards their ability to meet policyholder claims but also supports sustainable growth. Effective capital management strategies, integrated with ORSA processes, allow insurers to optimise their capital allocation and enhance overall financial resilience. By regularly assessing capital adequacy, firms can identify potential shortfalls and make necessary adjustments before they become problematic. This proactive approach fosters long-term stability and enhances stakeholder confidence in the insurer’s financial health.

Enterprise Risk Management (ERM)

Enterprise Risk Management (ERM) is a holistic approach to managing risks across an organization. In the context of insurance, ERM involves integrating risk management practices into all aspects of the company’s operations. ORSA is a vital component of ERM, providing a framework for insurers to assess and manage risks comprehensively.

A robust ERM framework not only enhances risk awareness but also supports the achievement of strategic objectives within the insurance industry. By fostering a culture of open communication about risks, companies can ensure that potential issues are identified early and addressed effectively. This entails regular training sessions and collaborative workshops that engage employees from all departments. Ultimately, a unified approach to risk management empowers insurers to navigate complexities while remaining aligned with their long-term vision.

Insurance Solvency Regulation

Insurance Solvency Regulation encompasses rules and guidelines that ensure insurance companies remain financially stable and capable of meeting policyholder obligations. ORSA is a critical element of solvency regulation, requiring insurers to assess their solvency positions and manage risks effectively.

In addition to regulatory compliance and risk management, effective communication is key to the success of insurance operations. Insurers must ensure that all stakeholders, including employees, policyholders, and regulators, are well-informed about the company’s risk management strategies and capital adequacy. This transparency fosters trust and encourages a collaborative environment where potential risks can be addressed proactively. By prioritising clear communication, insurance companies can strengthen their relationships and enhance their overall resilience in a dynamic market.

ORSA Report Requirements

ORSA Report Requirements specify the information that insurers must include in their ORSA reports. These reports provide insights into the company’s risk profile, solvency position, and risk management practices. Regulatory authorities use ORSA reports to evaluate the financial health and risk management capabilities of insurance companies.

A comprehensive understanding of ORSA report requirements is crucial for insurance companies to effectively communicate their risk management strategies and solvency status. By adhering to these guidelines, insurers can provide a thorough analysis of their risk exposures and the adequacy of capital held. This not only demonstrates regulatory compliance but also reinforces stakeholder confidence in the company’s financial stability. Furthermore, well-structured reporting facilitates informed decision-making processes within the organization, contributing to a proactive risk management culture.

Insurance Risk Evaluation

Insurance Risk Evaluation involves assessing the potential risks that can impact an insurance company’s operations and financial stability. ORSA facilitates comprehensive risk evaluation, enabling insurers to identify, quantify, and manage risks effectively. Robust risk evaluation practices contribute to the overall resilience of insurance companies.

An effective risk evaluation process often utilises a combination of qualitative and quantitative methods to ensure a thorough understanding of potential threats. By analysing historical data alongside current market trends, insurers can better anticipate future challenges. Engaging industry experts and employing advanced technological tools can enhance the accuracy of risk assessments. This multifaceted approach ultimately supports informed decision-making and strengthens the insurer’s ability to mitigate risks proactively.

Regulatory Risk Assessment

Regulatory Risk Assessment involves evaluating the risks associated with regulatory compliance. ORSA helps insurers assess their compliance with regulatory requirements and implement measures to address potential risks. Effective regulatory risk assessment ensures that insurers operate within the legal framework and avoid regulatory penalties.

Insurers must also stay abreast of evolving regulatory landscapes to remain compliant and mitigate potential risks. This includes tracking changes in legislation, understanding new regulatory requirements, and adjusting internal practices accordingly. By fostering strong relationships with regulatory bodies, companies can gain insights and guidance that enhance compliance efforts. Ultimately, active engagement in regulatory risk assessment is vital for maintaining a robust operational framework and ensuring long-term sustainability.

ORSA Implementation

ORSA Implementation refers to the process of integrating ORSA practices into an insurance company’s operations. Successful implementation involves establishing a robust ORSA framework, conducting regular risk and solvency assessments, and reporting findings to regulatory authorities. Effective ORSA implementation enhances risk management and regulatory compliance.

A successful ORSA implementation requires collaboration across all levels of the organization to ensure alignment with strategic objectives. This entails engaging stakeholders from various departments to provide insights and perspectives that enrich the risk assessment process. Regular training and updates about ORSA practices can help cultivate a culture of risk awareness and responsibility. Ultimately, the collective commitment to effective ORSA practices strengthens the insurer’s ability to navigate uncertainties and enhance operational resilience.

Risk Management Strategies

Risk Management Strategies are approaches used by insurers to identify, assess, and mitigate risks. ORSA supports the development and implementation of effective risk management strategies, ensuring that insurers can manage risks proactively and maintain financial stability.

Insurers should continually refine their risk management strategies to adapt to the changing landscape of the insurance industry. This includes leveraging data analytics and technology to predict potential risks and monitor their impacts more effectively. Collaboration with internal and external stakeholders can enhance the robustness of these strategies, leading to better-informed decisions. Ultimately, a proactive approach to risk management will not only safeguard the insurer’s financial health but also promote long-lasting relationships with policyholders and regulators.

Insurance Capital Management

Insurance Capital Management involves managing an insurance company’s capital to ensure solvency and financial stability. ORSA plays a crucial role in capital management by assessing the adequacy of capital levels and identifying potential capital shortfalls. Effective capital management protects policyholders and enhances the company’s financial resilience.

In addition to capital management, insurers must also focus on the importance of liquidity management to ensure they can meet short-term obligations. This involves maintaining an appropriate balance between liquid assets and liabilities, allowing the company to weather unexpected financial pressures. By conducting regular liquidity assessments, insurers can better prepare for fluctuations in policyholder claims and other financial demands. Ultimately, effective liquidity management complements the overall financial strategy and supports the insurer’s long-term stability.

ORSA Standards and Guidelines

ORSA Standards and Guidelines provide a framework for conducting ORSA assessments. These standards outline best practices for risk identification, assessment, and management, ensuring that insurers maintain robust risk management practices. Adhering to ORSA standards promotes transparency and consistency in the insurance industry.

Effective communication is essential in insurance risk evaluation to ensure that all stakeholders understand the associated risks and the strategies in place to manage them. Clear reporting and documentation facilitate informed decision-making and foster a culture of transparency within the organization. By encouraging open dialogue among team members, insurers can harness diverse perspectives that contribute to a more holistic approach to risk management. Ultimately, strengthening communication channels not only enhances risk assessments but also promotes collaboration and trust across all levels of the company.

Solvency Regulation in the US

Solvency Regulation in the US involves rules and guidelines established by regulatory authorities to ensure the financial stability of insurance companies. ORSA is a key component of solvency regulation in the US, requiring insurers to assess their risk profiles and maintain adequate capital levels.

Insurers must be proactive in their approach to solvency regulation, regularly reviewing their financial strategies to align with evolving regulatory standards. This involves not only adhering to established guidelines but also anticipating potential changes that may affect capital requirements. By employing robust forecasting and scenario analysis, companies can better prepare for uncertainties, ensuring that they remain resilient even in challenging market conditions. Ultimately, a thorough understanding of solvency regulation fosters confidence among policyholders and investors alike, reinforcing the insurer’s reputation in the marketplace.

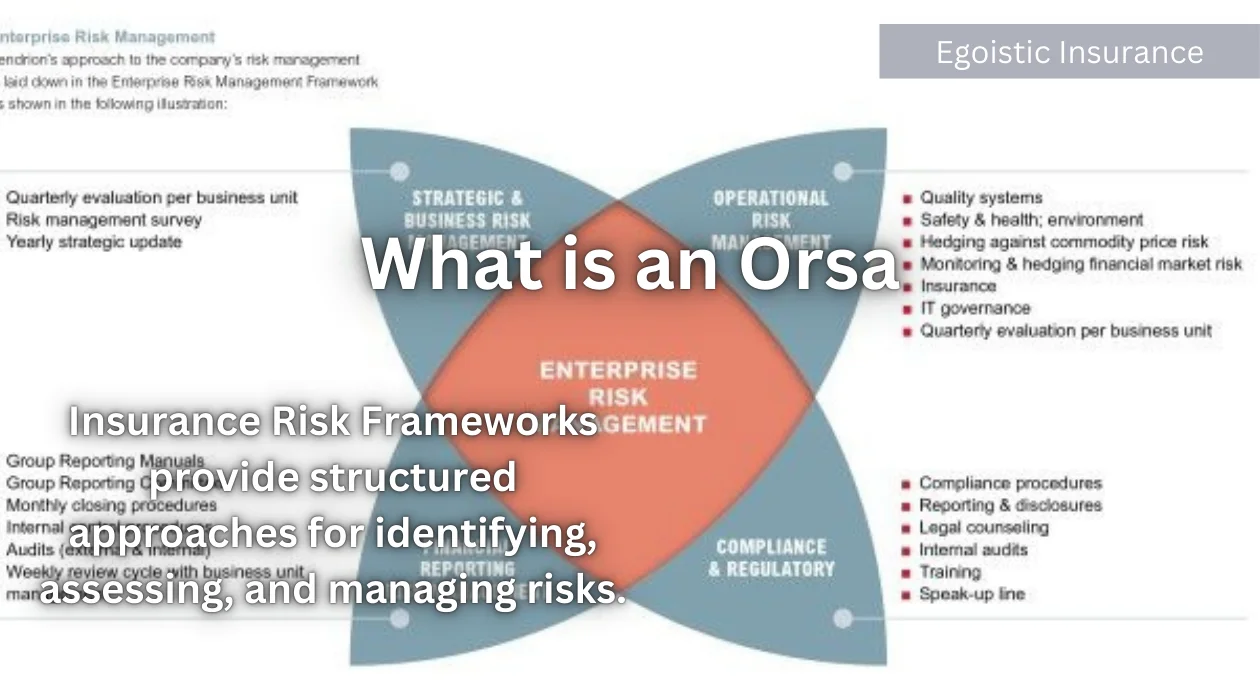

Insurance Risk Frameworks

Insurance Risk Frameworks provide structured approaches for identifying, assessing, and managing risks. ORSA is an integral part of these frameworks, facilitating comprehensive risk assessments and enhancing the company’s ability to manage risks effectively.

Incorporating a culture of continuous improvement within the insurance sector can significantly enhance risk management practices. By regularly evaluating and updating procedures, insurers can adapt to emerging threats and uncertainties more effectively. Encouraging a feedback loop among employees at all levels fosters innovation and helps identify potential weaknesses in existing frameworks. This proactive mindset not only boosts operational efficiency but also reinforces the company’s commitment to safeguarding policyholders’ interests.

Financial Solvency

Financial Solvency refers to an insurance company’s ability to meet its financial obligations and continue operations. ORSA ensures that insurers maintain financial solvency by assessing risk exposures and capital adequacy. Maintaining financial solvency is essential for protecting policyholders and promoting confidence in the insurance market.

A comprehensive approach to financial solvency must also include stress testing, which evaluates the insurer’s resilience under various adverse scenarios. By simulating extreme but plausible economic conditions, insurers can identify potential vulnerabilities and make informed adjustments to their risk management strategies. This proactive analysis not only enhances the understanding of capital adequacy but also supports the development of contingency plans. Ultimately, effective stress testing contributes to a robust financial posture, ensuring that insurers are well-prepared to navigate uncertainties in the marketplace.

Insurance Risk and Capital Models

Insurance Risk and Capital Models are tools used to assess and quantify risks and determine capital requirements. ORSA leverages these models to evaluate an insurer’s risk profile and capital adequacy. Effective use of risk and capital models enhances the accuracy and reliability of ORSA assessments.

In addition to the established frameworks and assessments, insurers must also embrace technology to enhance their risk management capabilities. Advanced analytics and data modeling techniques enable companies to better predict and mitigate risks, leading to improved decision-making processes. By integrating innovative tools, insurers can gain deeper insights into market trends and effectively respond to emerging threats. This technological adoption ultimately strengthens the insurer’s overall risk posture, providing greater assurance to both policyholders and stakeholders.

FAQs

What is ORSA?

ORSA, or Own Risk and Solvency Assessment, is a regulatory requirement for insurers that allows them to assess their risk exposure and ensure they have enough capital to maintain financial solvency.

Why is liquidity assessment important for insurers?

Regular liquidity assessments are crucial for insurers as they help them manage and prepare for fluctuations in policyholder claims and other financial demands, ultimately supporting long-term stability.

How do solvency regulations impact insurance companies?

Solvency regulations provide a framework that ensures insurance companies maintain adequate capital levels, which enhances their financial stability and protects policyholders.

What role do risk frameworks play in insurance risk management?

Insurance risk frameworks offer structured approaches for identifying, assessing, and managing risks, allowing insurers to effectively manage their risk profiles and comply with regulatory standards.

How can technology improve risk management in the insurance sector?

The integration of advanced analytics and data modeling techniques helps insurers predict and mitigate risks more effectively, leading to improved decision-making and a stronger risk posture.

Conclusion

In conclusion, effective risk management and solvency regulation are pivotal to the stability and integrity of the insurance industry. By leveraging frameworks such as ORSA, insurers can rigorously assess their risk exposures, maintain adequate capital levels, and foster a culture of continuous improvement. The integration of advanced technology and clear communication further enhances their capacity to navigate the complex landscape of risks and uncertainties. Ultimately, a robust risk management strategy not only safeguards policyholders’ interests but also builds trust and confidence among stakeholders, ensuring the long-term viability of insurance companies in an ever-evolving marketplace.

For more interesting information keep visiting egoisticinsurance.online